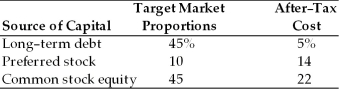

A firm has determined its cost of each source of capital and optimal capital structure, which is composed of the following sources and target market value proportions:  If the firm were to shift toward a more leveraged capital structure (i.e., a greater percentage of debt in the capital structure) , the weighted average cost of capital would

If the firm were to shift toward a more leveraged capital structure (i.e., a greater percentage of debt in the capital structure) , the weighted average cost of capital would

Definitions:

Current Ratio

A liquidity ratio that measures a company's ability to pay short-term obligations or those due within one year, calculated as current assets divided by current liabilities.

Capitalized Lease

A lease agreement accounted for as an asset and liability on the balance sheet, indicating ownership-like characteristics.

Lessee

The party in a lease agreement who obtains the right to use an asset in exchange for periodic lease payments.

Residual Value Guarantees

Promises made by lessees to lessors that the asset being leased will have a certain value at the end of the lease term.

Q2: According to the efficient market theory,<br>A) prices

Q20: The constant growth valuation model the Gordon

Q34: Luther's EBIT coverage ratio for the year

Q41: Which of the following statements is FALSE?<br>A)No

Q51: Define the following terms:<br>(a)perpetuity<br>(b)annuity<br>(c)growing perpetuity<br>(d)growing annuity

Q64: Based upon the information provided about securities

Q78: Dr. Dan is considering investment in a

Q88: A firm has common stock with a

Q92: The cost of capital is a dynamic

Q130: The value of zero for beta coefficient