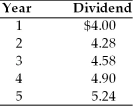

A firm has common stock with a market price of $100 per share and an expected dividend of $5.61 per share at the end of the coming year. A new issue of stock is expected to be sold for $98, with $2 per share representing the underpricing necessary in the competitive capital market. Flotation costs are expected to total $1 per share. The dividends paid on the outstanding stock over the past five years are as follows:  The cost of this new issue of common stock is

The cost of this new issue of common stock is

Definitions:

Corporate Social Responsibility

The concept that businesses should be accountable for their impact on society and the environment, going beyond profit-making to ethical, social, and ecological concerns.

Mary Parker Follett

An early 20th-century social worker and management consultant who emphasized the importance of human relations and collaborative management in organizations.

Maslow

A theory of human motivation that suggests people are motivated by a hierarchy of needs, starting from basic physiological needs to self-actualization.

Self-Actualized

Pertaining to the state of having achieved one's full potential, often associated with realizing personal talents and capabilities.

Q20: You overhear your manager saying that she

Q33: If the current rate of interest is

Q38: Nico bought an investment one year ago

Q57: You work for a pharmaceutical company that

Q79: You are up late watching TV one

Q80: Firms occasionally repurchase stock in order to

Q82: Assuming that college costs continue to increase

Q125: The cost of capital reflects the cost

Q130: The value of zero for beta coefficient

Q150: Total security risk is the sum of