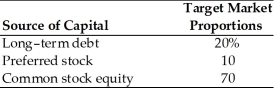

Table 9.1

A firm has determined its optimal capital structure which is composed of the following sources and target market value proportions.  Debt: The firm can sell a 12-year, $1,000 par value, 7 percent bond for $960. A flotation cost of

Debt: The firm can sell a 12-year, $1,000 par value, 7 percent bond for $960. A flotation cost of

2 percent of the face value would be required in addition to the discount of $40.

Preferred Stock: The firm has determined it can issue preferred stock at $75 per share par value. The stock will pay a $10 annual dividend. The cost of issuing and selling the stock is $3 per share.

Common Stock: A firm's common stock is currently selling for $18 per share. The dividend expected to be paid at the end of the coming year is $1.74. Its dividend payments have been growing at a constant rate for the last four years. Four years ago, the dividend was $1.50. It is expected that to sell, a new common stock issue must be underpriced $1 per share in floatation costs. Additionally, the firm's marginal tax rate is 40 percent.

-The firm's cost of preferred stock is ________. (See Table 9.1)

Definitions:

Express Contract

A clearly stated agreement between parties, with terms explicitly mentioned either orally or in writing.

Commodities

Commodities are raw materials or agricultural products that can be bought and sold, such as gold, oil, or grains.

Nonnegotiable

Something that cannot be bargained or altered; absolute or not subject to change.

Payment Schedule

A detailed plan outlining when and how financial payments are to be made.

Q9: An increase in the beta of a

Q11: You have an $8,000 balance on your

Q13: If the interest rate is 7%, the

Q34: The cost of capital can be thought

Q64: The major factor(s) affecting the cost, or

Q75: The weighted average cost of capital after

Q79: The future value at retirement (age 65)of

Q111: Behavioral finance is a growing body of

Q115: Violation of any standard or restrictive provision

Q120: _ are promised a fixed periodic dividend