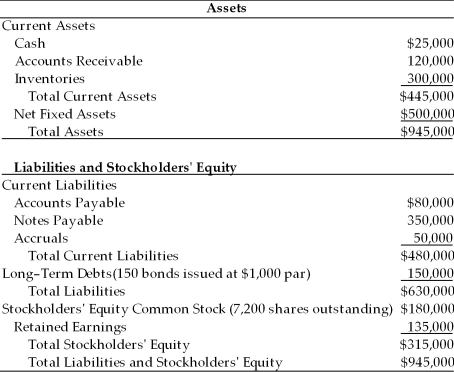

Table 9.3

Balance Sheet

General Talc Mines

December 31, 2003

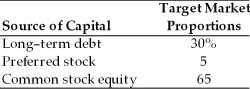

-A firm has determined its optimal capital structure, which is composed of the following sources and target market value proportions:  Debt: The firm can sell a 20-year, $1,000 par value, 9 percent bond for $980. A flotation cost of 2 percent of the face value would be required in addition to the discount of $20.

Debt: The firm can sell a 20-year, $1,000 par value, 9 percent bond for $980. A flotation cost of 2 percent of the face value would be required in addition to the discount of $20.

Preferred Stock: The firm has determined it can issue preferred stock at $65 per share par value. The stock will pay an $8.00 annual dividend. The cost of issuing and selling the stock is $3 per share.

Common Stock: The firm's common stock is currently selling for $40 per share. The dividend expected to be paid at the end of the coming year is $5.07. Its dividend payments have been growing at a constant rate for the last five years. Five years ago, the dividend was $3.45. It is expected that to sell, a new common stock issue must be underpriced at $1 per share and the firm must pay $1 per share in flotation costs. Additionally, the firm's marginal tax rate is 40 percent.

Calculate the firm's weighted average cost of capital assuming the firm has exhausted all retained earnings.

Definitions:

Conjunctivitis

An inflammation or infection of the outer membrane of the eyeball and the inner eyelid.

Blepharitis

An inflammation of the eyelids, typically involving the part where the eyelashes grow and resulting in red, irritated, itchy eyelids, and the formation of dandruff-like scales on the eyelashes.

Hyperopia

A common vision condition, also known as farsightedness, where distant objects are seen more clearly than near objects.

Glaucoma

A group of eye conditions that damage the optic nerve, often associated with abnormally high pressure in the eye, leading to vision loss.

Q6: The lower the coefficient of variation, the

Q42: Cash is a:<br>A)non-current asset.<br>B)current asset.<br>C)current liability.<br>D)non-current (long-term)liability.

Q57: A trustee is a paid party representing

Q62: Your son is about to start kindergarten

Q76: The preemptive right gives the shareholder the

Q80: If the appropriate interest rate is 8%,

Q87: Beta coefficient is an index of the

Q105: The theory suggesting that for any given

Q123: On average, during the past 75 years,

Q186: Investment A guarantees its holder $100 return.