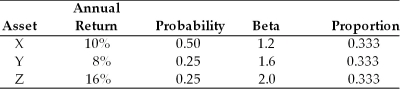

Table 8.2

You are going to invest $20,000 in a portfolio consisting of assets X, Y, and Z, as follows:

-What is the expected market return if the expected return on asset X is 20 percent, its beta is 1.5, and the risk free rate is 5 percent?

Definitions:

Anticipated Inflation

The rate of inflation that consumers, businesses, and investors expect to occur in the future.

Congressional Appropriations

The legal process by which the United States Congress allocates federal funds to various government agencies, departments, and programs.

Board of Governors

refers to the leading body or group of individuals overseeing the operations and policy-making of an organization, such as a central bank.

Monetary Policy

The macroeconomic policy laid down by the central bank involving management of money supply and interest rate to control inflation, consumption, growth, and liquidity.

Q15: A 30 year mortgage loan is a:<br>A)non-current

Q28: Luther's Net Profit Margin for the year

Q54: In the US the Sarbanes-Oxley Act (SOX)was

Q77: If ECE reported $15 million in net

Q89: The liquidity preference theory suggests that short-term

Q94: The purpose of the restrictive debt covenant

Q136: Following the theory of the "efficient market

Q167: To pay for her college education, Gina

Q207: When valuing a bond, the characteristics of

Q217: The nominal rate of interest is equal