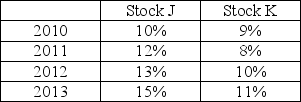

Given the returns of two stocks J and K in the table below over the next 4 years. Find the expected return and standard deviation of holding a portfolio of 40% of stock J and 60% in stock K over the next 4 years:

Definitions:

Negotiable Instrument

A written document guaranteeing the payment of a specific amount of money, either on demand or at a set time, with the payee's name on it.

Unconditional Promise

A pledge or commitment that does not depend on any conditions or stipulations for its fulfillment.

Pay

The remuneration or salary provided to an individual in exchange for their labor or services.

Cash Substitute

Forms of payment other than traditional cash, such as credit cards, debit cards, or electronic transfers, that are used as alternatives to cash.

Q3: Tangshan China's stock is currently selling for

Q5: The Gordon model is based on the

Q11: You have an $8,000 balance on your

Q60: From a bond issuer's perspective, the IRR

Q81: Assuming that Luther has no convertible bonds

Q84: What would be the cost of retained

Q110: Xiao Xin owns stock in a company

Q156: The _ rate of interest is typically

Q157: Tina's Medical Equipment Company paid $2.25 common

Q190: A debenture is<br>A) a lengthy legal document