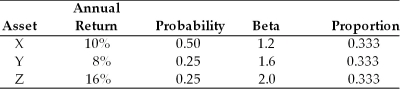

Table 8.2

You are going to invest $20,000 in a portfolio consisting of assets X, Y, and Z, as follows:

-What is the expected market return if the expected return on asset X is 20 percent, its beta is 1.5, and the risk free rate is 5 percent?

Definitions:

Reverse Stock Split

A corporate action in which a company reduces the number of its existing shares to increase the share price without changing the company's valuation.

Stock Repurchase

A situation where a company buys back its own shares from the marketplace, potentially increasing the value of remaining shares.

Stock Dividend

A dividend payment made in the form of additional shares rather than a cash payout.

Q4: Which of the following is NOT an

Q39: A portfolio of two negatively correlated assets

Q41: The _ of an asset is the

Q48: A firm has issued preferred stock at

Q61: Two assets whose returns move in the

Q122: The _ from the sale of a

Q142: Standard debt provisions specify certain criteria of

Q174: Draw a graph of a typical Treasury

Q184: If you expect the market to increase

Q185: In the capital asset pricing model, the