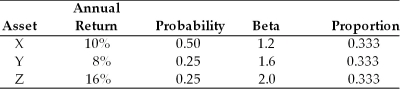

Table 8.2

You are going to invest $20,000 in a portfolio consisting of assets X, Y, and Z, as follows:

-What is Nico's portfolio beta if he invests an equal amount in asset X with a beta of 0.60, asset Y with a beta of 1.60, the risk-free asset, and the market portfolio?

Definitions:

Revenues

The income generated from normal business operations and includes discounts and deductions for returned merchandise.

Expenses

Outflows of resources or incurrences of liabilities that result in a decrease in the equity of a company, other than distributions to owners.

Accounts Receivable

Money owed to a company by its customers for goods or services provided on credit.

Trial Balance

A bookkeeping report that lists the balances of all ledgers accounts to check the arithmetic accuracy of the accounts.

Q34: Luther's EBIT coverage ratio for the year

Q39: If on December 31, 2011 Luther has

Q82: Hewitt Packing Company has an issue of

Q86: When using the book value of equity,

Q110: Which asset would the risk-averse financial manager

Q113: _ probability distribution shows all possible outcomes

Q129: Debentures such as convertible bonds are unsecured

Q129: The firm's before-tax cost of debt is

Q130: The value of zero for beta coefficient

Q147: Everything else being equal, the higher the