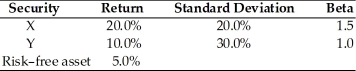

Table 8.3

Consider the following two securities X and Y.

-Using the data from Table 8.3, what is the portfolio expected return and the portfolio beta if you invest 35 percent in X, 45 percent in Y, and 20 percent in the risk-free asset?

Definitions:

Learning

The process of acquiring new knowledge, behaviors, skills, values, or preferences through study, experience, or teaching.

Outsourcing

The practice of hiring third-party companies or individuals to perform tasks, handle operations, or provide services that are either difficult to manage or are outside the company's expertise.

Employee Morale Risks

The potential negative effects on an organization's performance due to reduced employee satisfaction and engagement.

Bottom Line

The final net income reported by a company, indicating the company's profitability, or metaphorically, the most important or fundamental aspect of a situation.

Q6: To carry out the sinking fund requirements,

Q16: Perrigo's return on equity (ROE)is closest to:<br>A)4.6%<br>B)9.1%<br>C)17.2%<br>D)27%

Q46: The shorter the amount of time until

Q73: Combining two negatively correlated assets to reduce

Q74: The amount of the claim of preferred

Q87: Increases in the basic cost of long-term

Q118: Compute the value of a share of

Q124: Circumstances in which the constant growth valuation

Q137: On average, during the past 75 years,

Q188: Ted has 10 shares of the Men's