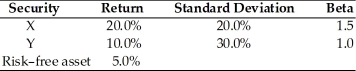

Table 8.3

Consider the following two securities X and Y.

-Using the data from Table 8.3, what is the portfolio expected return if you invest 100 percent of your money in X, borrow an amount equal to half of your own investment at the risk-free rate and invest your borrowings in asset X?

Definitions:

Confidence Interval

A variety of values coming from collected sample information, presumed to hold the value of an unknown parameter within the population.

Service Time

Service time refers to the amount of time required to complete a particular task or service, often used in the context of customer service or manufacturing.

Sample Means

The average value of a set of observations taken from a population, used as an estimate of the population mean.

Public Service Jobs

Employment positions within governmental organizations or agencies serving the public, often focused on providing administrative, healthcare, educational, or safety services.

Q2: According to the efficient market theory,<br>A) prices

Q11: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2927/.jpg" alt=" Given this after-tax

Q15: Restrictive covenants, which are also known as

Q24: The free cash flow valuation model is

Q45: The security market line is not stable

Q134: Treasury stock is generally reclassified as class

Q143: Restrictive covenants are contractual clauses in long-term

Q146: At year end, Tangshan China Company balance

Q148: The _ of an event occurring is

Q167: Changes in risk aversion, and therefore shifts