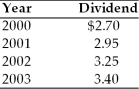

Tangshan Antiques has a beta of 1.40, the annual risk-free rate of interest is currently 10 percent, and the required return on the market portfolio is 16 percent. The firm estimates that its future dividends will continue to increase at an annual compound rate consistent with that experienced over the 2000-2003 period.  (a) Estimate the value of Tangshan Antiques stock.

(a) Estimate the value of Tangshan Antiques stock.

(b) A lawsuit has been filed against the company by a competitor, and the potential loss has increased risk, which is reflected in the company's beta, increasing it to 1.6. What is the estimated price of the stock following the filing of the lawsuit.

Definitions:

Bacteria

Microscopic, single-celled organisms found in diverse environments, some of which can cause diseases while others are beneficial for processes such as fermentation or digestion.

Viruses

Microscopic infectious agents that can reproduce only inside the living cells of an organism and are capable of causing diseases.

Production Possibilities Curve

A graphical representation that shows the maximum possible output combinations of two products that can be produced with available resources and technology.

Economic Wants

Desires that can be satisfied through the consumption of goods and services, reflecting the unlimited and varying needs and wishes of consumers.

Q1: Luther Corporation's stock price is $39 and

Q21: The most senior financial manager in a

Q25: Which of the following adjustments to net

Q29: Luther's earnings before interest, taxes, depreciation, and

Q29: Which of the following statements is FALSE?<br>A)In

Q46: The approximate before-tax cost of debt for

Q60: If the discount rate is 15%, the

Q66: The future value of $100 received today

Q159: The coefficient of variation is a measure

Q171: The possibility that the issuer of a