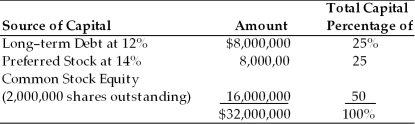

Zheng Sen's Chinese Take-Out had earnings before interest and taxes of $4,000,000 last year. The firm has a marginal tax rate of 40 percent and currently has the following capital structure:  (a) Calculate the firm's after-tax return on equity (ROE) and earnings per share (EPS).

(a) Calculate the firm's after-tax return on equity (ROE) and earnings per share (EPS).

(b) If the firm retires $4,000,000 of preferred stock using the proceeds from an equal increase in long-term debt, what would have been the after-tax return on equity (ROE) and earnings per share (EPS)?

(c) If the firm retires $4,000,000 of preferred stock using the proceeds from the sale of 500,000 shares of common stock, what would have been the after-tax return on equity (ROE) and earnings per share (EPS)?

Definitions:

Treasury Stock

Shares that were once part of the circulating supply but were bought back by the company, thus reducing the amount of outstanding stock.

Selling Price

The amount for which a product or service is sold to customers.

Paid-in Capital

Funds received by a company from equity investors in exchange for stock, representing the capital staked by shareholders in the company.

Treasury Stock

Shares that were issued and subsequently reacquired by the issuing company, removing them from the market.

Q12: Any bond rated according to Moody's Ba

Q16: Advantages of issuing common stock versus long-term

Q24: If you buy shares of Coca-Cola on

Q77: If ECE reported $15 million in net

Q93: Find the future value at the end

Q138: A firm has an expected dividend next

Q148: Milton Corporation recently paid a dividend of

Q158: What effective annual rate of return (EAR)

Q176: Diversifiable risk is the relevant portion of

Q213: When a bond's required return is greater