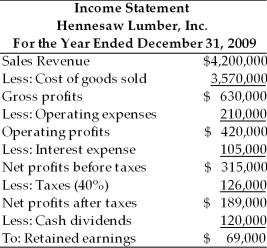

Table 4.4

Use the percent-of-sales method to prepare a pro forma income statement for the year ended December 31, 2010, for Hennesaw Lumber, Inc.

Hennesaw Lumber, Inc. estimates that its sales in 2000 will be $4,500,000. Interest expense is to remain unchanged at $105,000 and the firm plans to pay cash dividends of $150,000 during 2010. Hennesaw Lumber, Inc.'s income statement for the year ended December 31, 2009 is shown below. From your preparation of the pro forma income statement, answer the following multiple choice questions.

-The pro forma net profits after taxes for 2010 are ________. (See Table 4.4)

Definitions:

Auto Insurance

A type of insurance policy that covers vehicles and their drivers against potential financial losses related to accidents, theft, or damage.

Commercial Business

An organization engaged in activities aimed at the sale of goods and services to consumers with the goal of earning profit.

Insurable Interests

A legal requirement indicating that a person must have a legitimate stake in the safety or preservation of an item or life to insure it.

Investment Lenders

Professionals or institutions that provide capital to companies, individuals, or investors in exchange for interest payments and repayment of the principal at a future date.

Q30: The present value of an ordinary annuity

Q35: The _ is created by a financial

Q46: All of the following are considered to

Q51: The _ is created by a number

Q54: In the statement of cash flows, the

Q66: The firm has a total financing requirement

Q78: In general, most corporate capital gains are

Q127: The tax loss carryforward benefits can be

Q136: Depreciation is considered to be an outflow

Q174: An operating merger occurs when the operations