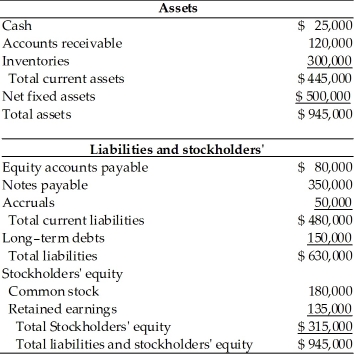

Table 4.5

A financial manager at General Talc Mines has gathered the financial data essential to prepare a pro forma balance sheet for cash and profit planning purposes for the coming year ended December 31, 2015. Using the percent-of-sales method and the following financial data, prepare the pro forma balance sheet in order to answer the following multiple choice questions.

(a) The firm estimates sales of $1,000,000.

(b) The firm maintains a cash balance of $25,000.

(c) Accounts receivable represents 15 percent of sales.

(d) Inventory represents 35 percent of sales.

(e) A new piece of mining equipment costing $150,000 will be purchased in 2010.

Total depreciation for 2010 will be $75,000.

(f) Accounts payable represents 10 percent of sales.

(g) There will be no change in notes payable, accruals, and common stock.

(h) The firm plans to retire a long term note of $100,000.

(i) Dividends of $45,000 will be paid in 2015.

(j) The firm predicts a 4 percent net profit margin.

Balance Sheet

General Talc Mines

December 31, 2014

-The pro forma total current assets amount is ________. (See Table 4.5)

Definitions:

Pancreas

An organ in the digestive system that produces enzymes and hormones, including insulin, to aid in digestion and regulate blood sugar.

Plasma Calcium Levels

The concentration of calcium in the plasma portion of the blood, important for various bodily functions including bone formation and muscle contraction.

Amnesia

A condition characterized by memory loss that can be caused by brain injury, disease, or psychological trauma.

Analgesia

The inability to feel pain, often achieved through the use of medications.

Q3: A feature that allows bondholders to change

Q21: The marginal tax rate represents the rate

Q38: The World Trade Organization has in recent

Q51: The _ is created by a number

Q86: The transfer by a multinational firm of

Q102: The nominal (stated) annual rate is the

Q118: _ evidence of the existence of a

Q121: Based on the Table 6.1, assume this

Q128: Mr. & Mrs. Pribel wish to purchase

Q145: John borrowed $12,000 to buy a new