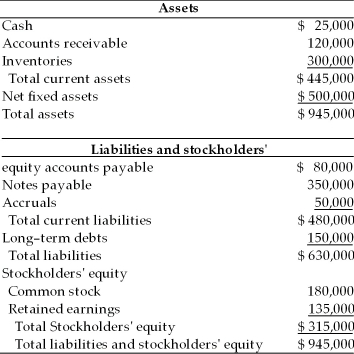

Table 4.5

A financial manager at General Talc Mines has gathered the financial data essential to prepare a pro forma balance sheet for cash and profit planning purposes for the coming year ended December 31, 2010. Using the percent-of-sales method and the following financial data, prepare the pro forma balance sheet in order to answer the following multiple choice questions.

(a) The firm estimates sales of $1,000,000.

(b) The firm maintains a cash balance of $25,000.

(c) Accounts receivable represents 15 percent of sales.

(d) Inventory represents 35 percent of sales.

(e) A new piece of mining equipment costing $150,000 will be purchased in 2010.

Total depreciation for 2010 will be $75,000.

(f) Accounts payable represents 10 percent of sales.

(g) There will be no change in notes payable, accruals, and common stock.

(h) The firm plans to retire a long term note of $100,000.

(i) Dividends of $45,000 will be paid in 2010.

(j) The firm predicts a 4 percent net profit margin.

Balance Sheet

General Talc Mines

December 31, 2009

-The external financing required in 2010 will be ________. (See Table 4.5)

Definitions:

Criminal Activity

Actions that involve conduct deemed illegal by law, potentially leading to prosecution and punishment.

Working-Class

A social group consisting of people employed in low-paying wage jobs or manual labor.

Merton

Refers to Robert K. Merton, an influential American sociologist known for his theories on social structure, anomie, and the sociology of science.

Anomie

A condition in society characterized by a breakdown or absence of social norms and values, often leading to a state of normlessness.

Q32: Recent years have seen the emergence of

Q35: In the international context, the nominal interest

Q47: A firm with a total asset turnover

Q49: On December 31, 2004, the Bradshaw Corporation

Q80: A decrease in total asset turnover will

Q83: The cost of long-term debt generally _

Q108: The foreign direct investment (FDI) is a

Q162: _ are especially interested in the average

Q170: A firm has projected sales in May,

Q172: The value of an asset depends on