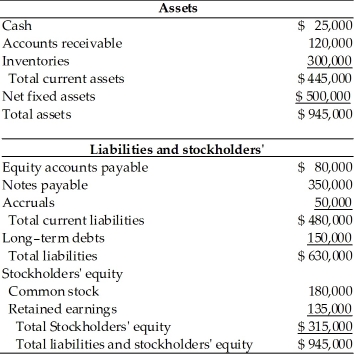

Table 4.5

A financial manager at General Talc Mines has gathered the financial data essential to prepare a pro forma balance sheet for cash and profit planning purposes for the coming year ended December 31, 2015. Using the percent-of-sales method and the following financial data, prepare the pro forma balance sheet in order to answer the following multiple choice questions.

(a) The firm estimates sales of $1,000,000.

(b) The firm maintains a cash balance of $25,000.

(c) Accounts receivable represents 15 percent of sales.

(d) Inventory represents 35 percent of sales.

(e) A new piece of mining equipment costing $150,000 will be purchased in 2010.

Total depreciation for 2010 will be $75,000.

(f) Accounts payable represents 10 percent of sales.

(g) There will be no change in notes payable, accruals, and common stock.

(h) The firm plans to retire a long term note of $100,000.

(i) Dividends of $45,000 will be paid in 2015.

(j) The firm predicts a 4 percent net profit margin.

Balance Sheet

General Talc Mines

December 31, 2014

-The external funds requirement results primarily from ________. (See Table 4.5)

Definitions:

Psychosocial Support

Assistance provided to individuals or communities to help them cope with psychological and social challenges.

Psychosocial Functions

The roles that relationships and social networks play in shaping a person's psychological development and functioning.

Role Modeling

The process by which individuals pattern their behavior on the behavior of others whom they admire or wish to emulate.

Protégé

An individual who is guided and supported by a more experienced or influential person.

Q8: _ is a treaty that has governed

Q21: A bond that is initially sold primarily

Q50: The depreciable value of an asset, under

Q55: The motive for divestiture is often to

Q79: Find the future value at the end

Q85: Gerry Jacobs, a financial analyst for Best

Q97: It would be correct to define Operating

Q104: A firm had year end 2004 and

Q123: Inflation can distort<br>A) inventory costs.<br>B) cost of

Q149: A firm plans to depreciate a five