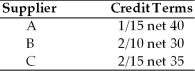

Ashley's Delivery Service is analyzing the credit terms of each of three suppliers, A, B, and C.  (a) Determine the approximate cost of giving up the cash discount.

(a) Determine the approximate cost of giving up the cash discount.

(b) Assuming the firm needs short-term financing, recommend whether or not the firm should give up the cash discount or borrow from the bank at 10 percent annual interest. Evaluate each supplier separately.

Definitions:

Trumpet

A brass wind instrument with a flared bell and three buttons (valves) that is commonly used in classical and jazz music.

Pyrotechnics

The art, craft, or science of making and using fireworks or related explosive devices for entertainment, military, or industrial purposes.

Fourth of July

A U.S. holiday commemorating the Declaration of Independence of the United States, on July 4, 1776.

Pyrotechnics

The art and science of making fireworks, including the design and manufacture of devices that produce light, sound, and smoke for entertainment purposes.

Q2: The exercise price or option price of

Q9: A firm issued $2 million worth of

Q10: As a foreign exchange hedging tool, options

Q34: In general, the market value of a

Q82: Many holders of convertible bonds will not

Q86: Tangshan Mining borrowed $100,000 for one year

Q96: The dividend payment date is set by

Q105: What is the cost of marginal bad

Q156: XYZ Corporation borrowed $100,000 for six months

Q167: If a firm anticipates stretching accounts payable,