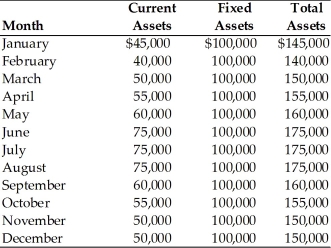

Table 15.1

Irish Air Services has determined several factors relative to its asset and financing mix.

(a) The firm earns 10 percent annually on its current assets.

(b) The firm earns 20 percent annually on its fixed assets.

(c) The firm pays 13 percent annually on current liabilities.

(d) The firm pays 17 percent annually on long-term funds.

(e) The firm's monthly current, fixed, and total asset requirements for the previous year are summarized in the table below:

-The firm's monthly average seasonal funds requirement is ________. (See Table 15.1)

Definitions:

FIFO Method

First In, First Out, an inventory valuation method that assumes the items purchased or produced first are sold first.

Equivalent Units

A concept used in cost accounting to convert partially completed goods into a number of fully completed units for accounting purposes.

Labor

The human effort, either physical or mental, that is used in the production of goods and services.

Overhead

Indirect costs related to manufacturing or business operations that do not directly tie to a specific product or activity, such as utilities, rent, and management salaries.

Q12: By using convertible bonds, the issuing firm

Q30: The residual theory of dividends implies that

Q93: At the operating breakeven point, _ equals

Q120: When a firm initiates or increases a

Q140: Much of the commercial paper is issued

Q141: If the firm's credit period in decreased,

Q176: Tony's Beach T-Shirts has fixed annual operating

Q265: Treasury notes are obligations of the U.S.

Q295: A decrease in the average age of

Q297: Certain financing plans are termed conservative when<br>A)