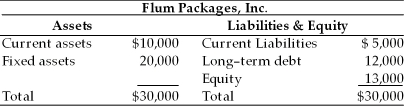

Table 15.2  The company earns 5 percent on current assets and 15 percent on fixed assets. The firm's current liabilities cost 7 percent to maintain and the average annual cost of long-term funds is 20 percent.

The company earns 5 percent on current assets and 15 percent on fixed assets. The firm's current liabilities cost 7 percent to maintain and the average annual cost of long-term funds is 20 percent.

-If the firm was to shift $3,000 of current assets to fixed assets, the firm's net working capital would ________, the annual profits on total assets would ________, and the risk of technical insolvency would ________, respectively. (See Table 15.2)

Definitions:

Current Yield

Yearly returns in the form of interest or dividends as a ratio of the security's present price.

Coupon

A coupon is the interest payment made to bondholders, usually on an annual or semi-annual basis.

Market Rate of Interest

The prevailing rate at which interest is paid by borrowers for accessing funds in the financial market.

Selling For

The process or act of offering goods or assets for sale at a particular price.

Q3: Stock repurchases may be made for all

Q19: The market value of a convertible bond

Q39: In EOQ model, the average inventory is

Q43: In general, the more net working capital

Q44: _ is an arrangement initiated by the

Q48: Tangshan Mining borrowed $10,000 for one year

Q98: The Jobs Growth Tax Relief Reconciliation Act

Q105: What is the cost of marginal bad

Q124: In a voluntary settlement, composition is an

Q125: One of the key inputs to the