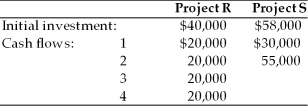

A firm is evaluating two mutually exclusive projects that have unequal lives. The firm must evaluate the projects using the annualized net present value approach and recommend which project they should select. The firm's cost of capital has been determined to be 14 percent, and the projects have the following initial investments and cash flows:

Definitions:

Normal Profit Margin

The average or expected profit margin that a business aims to achieve under normal operating conditions.

Allowance Method

An accounting technique used to account for expected credit losses on accounts receivable by anticipating uncollectible accounts.

Market Valuation

Market valuation is the process of determining the monetary value of a company or asset in the marketplace, typically reflected in its stock price or the total market capitalization.

Direct Method

A cash flow statement presentation that itemizes the major categories of gross cash receipts and payments, providing a clearer view of a company's cash flow from operating activities.

Q23: One way often used to insure that

Q58: The financial manager recognizes revenues and expenses

Q60: Stock repurchases are made for all of

Q61: The position of a particle moving along

Q76: In general, the market rewards firms that

Q82: The base level of EBIT must be

Q83: If an investment in a new asset

Q92: Which projects should the firm implement? (See

Q103: The officer responsible for the firm's accounting

Q321: _ is a method of consciously anticipating