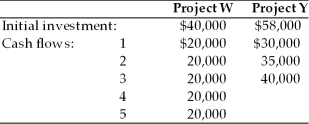

A firm is evaluating two mutually exclusive projects that have unequal lives. The firm must evaluate the projects using the annualized net present value approach and recommend which project they should select. The firm's cost of capital has been determined to be 18 percent, and the projects have the following initial investments and cash flows:

Definitions:

Normal Model

A statistical representation where most occurrences happen around the central peak and probabilities for values decrease as they move away from the mean.

Standard Deviation

A statistical measure of the dispersion or variability in a dataset, indicating how spread out the numbers are from the mean.

Normal Model

A statistical model that describes how data points are distributed around the mean, assuming a symmetrical bell-shaped curve known as the normal distribution.

Scores Between

A reference to evaluating or comparing numerical values or results within a specified range.

Q23: The tax treatment regarding the sale of

Q43: Calculate the initial investment of the new

Q53: With the existence of fixed operating costs,

Q63: Which of the following statements is false?<br>A)

Q85: Modigliani and Miller argue that when the

Q90: A corporation borrows $1,000,000 at 10 percent

Q100: Business risk is the risk to the

Q112: Relevant cash flows are the incremental cash

Q116: If an asset is sold for book

Q128: _ risk is the risk of being