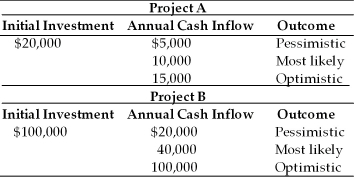

Table 12.1

A corporation is assessing the risk of two capital budgeting proposals. The financial analysts have developed pessimistic, most likely, and optimistic estimates of the annual cash inflows which are given in the following table. The firm's cost of capital is 10 percent.

-If the projects have five-year lives, the range of the net present value for Project B is approximately ________. (See Table 12.1)

Definitions:

Oxygen Level

The concentration of oxygen in the blood, essential for maintaining bodily functions and often measured using pulse oximetry.

Sensor

A device that detects or measures a physical property and records, indicates, or otherwise responds to it, often used in various technological and scientific applications.

Sphygmomanometer

A medical device used to measure blood pressure, consisting of an inflatable cuff to restrict blood flow and a manometer to measure the pressure.

Systolic Pressure

The pressure in the arteries when the heart beats and fills them with blood; the higher number in a blood pressure reading.

Q3: The net effect of changes in the

Q12: The risk-adjusted discount rate can be computed

Q16: If the NPV is greater than the

Q69: A nonconventional cash flow pattern is one

Q101: The Annualized NPV of project B is

Q130: A firm with limited dollars available for

Q131: In capital budgeting, the preferred approaches in

Q166: Many firms use the payback method as

Q171: Yongman Electronics has decided to invest $10,000,000

Q299: The yield on commercial paper is generally