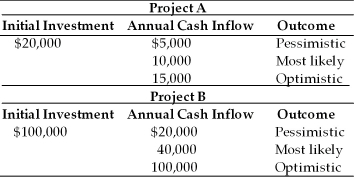

Table 12.1

A corporation is assessing the risk of two capital budgeting proposals. The financial analysts have developed pessimistic, most likely, and optimistic estimates of the annual cash inflows which are given in the following table. The firm's cost of capital is 10 percent.

-The expected net present value of project A if the outcomes are equally probable and the project has five-year life is ________. (See Table 12.1)

Definitions:

Desert Plants

Plants adapted to arid environments with strategies to conserve water, such as deep roots and reduced leaf surface area.

Conserve Water

The practice of using water efficiently to reduce unnecessary water consumption.

Lose Heat

The process by which an object or organism transfers heat to its surroundings, leading to a decrease in its own temperature.

Cattle Grazing

The practice of allowing livestock, specifically cattle, to feed on grass in open fields or pastures.

Q12: Some firms use the payback period as

Q44: Institutional investors are professional investors who work

Q76: What is the IRR for the following

Q103: The officer responsible for the firm's accounting

Q106: The part of finance concerned with design

Q108: A firm is analyzing a relaxation of

Q111: The accept-reject approach involves the ranking of

Q112: The _ is responsible for evaluating and

Q164: The net present value is found by

Q194: The operating breakeven point can be found