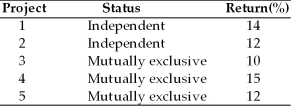

A firm with unlimited funds must evaluate five projects. Projects 1 and 2 are independent and Projects 3, 4, and 5 are mutually exclusive. The projects are listed with their returns.  A ranking of the projects on the basis of their returns from the best to the worst according to their acceptability to the firm would be

A ranking of the projects on the basis of their returns from the best to the worst according to their acceptability to the firm would be

Definitions:

Two-Tail

Describes tests or intervals in statistics that consider extreme values in both tails of the distribution to test hypotheses or compute confidence intervals.

P-Value

The probability of observing data at least as extreme as the data actually observed, under the assumption that the null hypothesis is true.

Null Hypothesis

A default hypothesis that there is no significant difference or effect, used as a starting point for statistical testing.

P-Value

The probability of observing test results at least as extreme as the results actually observed, under the assumption that the null hypothesis is true.

Q7: A project must be rejected if its

Q13: One mole of the carbon-12 isotope contains

Q13: A financial manager must choose between three

Q14: When unequal-lived projects are independent, the length

Q35: In planning and managing the requirements of

Q38: The key role of the financial manager

Q39: A firm that has a large percentage

Q58: The tax treatment regarding the sale of

Q99: A capital expenditure is an outlay of

Q106: Using the net present value approach to