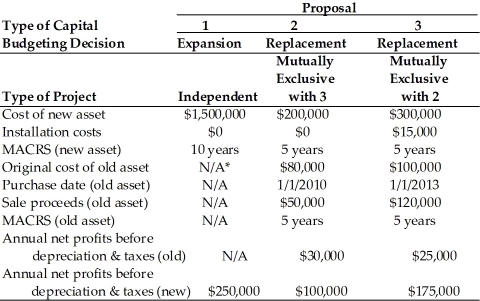

Table 11.2

Computer Disk Duplicators, Inc. has been considering several capital investment proposals for the year beginning in 2014. For each investment proposal, the relevant cash flows and other relevant financial data are summarized in the table below. In the case of a replacement decision, the total installed cost of the equipment will be partially offset by the sale of existing equipment. The firm is subject to a 40 percent tax rate on ordinary income and on long-term capital gains. The firm's cost of capital is 15 percent.

________________________________________________________  *Not applicable

*Not applicable

-For Proposal 1, the initial outlay equals ________. (See Table 11.2)

Definitions:

Corporate Takeover

The acquisition of one company by another, through either direct purchase or by acquiring a majority stake in the target company’s equity.

P/E Ratio

The price-to-earnings ratio, a measure of a company's current share price relative to its per-share earnings.

Debt-equity Ratio

A measure of a company's financial leverage calculated by dividing its total liabilities by its shareholder equity, indicating how much debt is used to finance assets.

Book Value

The net value of a company's assets minus its liabilities, often used to estimate the value of a company if it were to be liquidated.

Q7: A project must be rejected if its

Q19: Refer to Exhibit 3-1.What is the magnitude

Q42: Refer to Exhibit 3-3.Which diagram below correctly

Q68: A firm has fixed operating costs of

Q93: The book value of an asset is

Q95: Mutually exclusive projects are projects whose cash

Q100: A firm is evaluating two independent projects

Q106: The payment of a stock dividend is

Q137: _ risk is the risk of being

Q146: The evaluation of capital expenditure proposals to