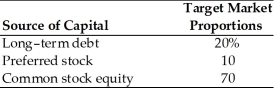

Table 9.1

A firm has determined its optimal capital structure which is composed of the following sources and target market value proportions.  Debt: The firm can sell a 12-year, $1,000 par value, 7 percent bond for $960. A flotation cost of

Debt: The firm can sell a 12-year, $1,000 par value, 7 percent bond for $960. A flotation cost of

2 percent of the face value would be required in addition to the discount of $40.

Preferred Stock: The firm has determined it can issue preferred stock at $75 per share par value. The stock will pay a $10 annual dividend. The cost of issuing and selling the stock is $3 per share.

Common Stock: A firm's common stock is currently selling for $18 per share. The dividend expected to be paid at the end of the coming year is $1.74. Its dividend payments have been growing at a constant rate for the last four years. Four years ago, the dividend was $1.50. It is expected that to sell, a new common stock issue must be underpriced $1 per share in floatation costs. Additionally, the firm's marginal tax rate is 40 percent.

-The firm's cost of preferred stock is ________. (See Table 9.1)

Definitions:

Amygdala

A small, almond-shaped cluster of nuclei located deep within the temporal lobe of the brain, involved in processing emotions such as fear, anger, and pleasure.

Cortex

The outermost layer of the brain, involved in numerous high-level brain functions such as thought, memory, and decision-making.

Carroll Izard

An American psychologist known for his contributions to the understanding of emotions, including the development of the Differential Emotions Theory.

Basic Emotions

Fundamental emotions that are universally experienced by humans, such as joy, sadness, fear, disgust, surprise, and anger.

Q27: The graph below shows the value of

Q34: The reaction <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2295/.jpg" alt="The reaction

Q44: What is the maximum kinetic energy (in

Q45: The major factors affecting the cost of

Q55: Which of the following statements is true?<br>A)

Q65: As a form of financing, equity capital<br>A)

Q117: A firm may face increases in the

Q158: The beta of the portfolio in Table

Q179: If expected return is less than required

Q222: The purpose of the restrictive debt covenant