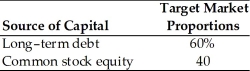

Table 9.2

A firm has determined its optimal structure which is composed of the following sources and target market value proportions.  Debt: The firm can sell a 15-year, $1,000 par value, 8 percent bond for $1,050. A flotation cost of 2 percent of the face value would be required in addition to the premium of $50.

Debt: The firm can sell a 15-year, $1,000 par value, 8 percent bond for $1,050. A flotation cost of 2 percent of the face value would be required in addition to the premium of $50.

Common Stock: A firm's common stock is currently selling for $75 per share. The dividend expected to be paid at the end of the coming year is $5. Its dividend payments have been growing at a constant rate for the last five years. Five years ago, the dividend was $3.10. It is expected that to sell, a new common stock issue must be underpriced $2 per share and the firm must pay $1 per share in flotation costs. Additionally, the firm has a marginal tax rate of 40 percent.

-The weighted average cost of capital up to the point when retained earnings are exhausted is ________. (See Table 9.2)

Definitions:

Sales Practice Abuses

Unethical or illegal business practices related to the selling of securities, often involving misleading information or high-pressure sales tactics.

Insider Trading

Insider Trading refers to the buying or selling of a publicly traded company's stock by someone who has non-public, material information about that stock.

Financial Reporting Releases (FRRs)

Official documents issued by regulatory bodies, providing guidelines and interpretations related to financial reporting standards.

Accounting Principles

Fundamental concepts and guidelines for financial reporting and accounting practices, beyond those defined strictly by GAAP.

Q8: The _ is a measure of relative

Q9: The omega-minus particle decays <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2295/.jpg" alt="The

Q21: The firm's cost of retained earnings is

Q31: A pendulum located where <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2295/.jpg" alt="A

Q42: The free cash flow valuation model can

Q46: An ADR is<br>A) a claim issued by

Q63: The weighted average cost of capital after

Q88: Most managers are risk-averse, since for a

Q101: When the U.S. currency gains in value,

Q108: The cost of capital reflects the cost