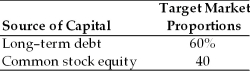

Table 9.2

A firm has determined its optimal structure which is composed of the following sources and target market value proportions.  Debt: The firm can sell a 15-year, $1,000 par value, 8 percent bond for $1,050. A flotation cost of 2 percent of the face value would be required in addition to the premium of $50.

Debt: The firm can sell a 15-year, $1,000 par value, 8 percent bond for $1,050. A flotation cost of 2 percent of the face value would be required in addition to the premium of $50.

Common Stock: A firm's common stock is currently selling for $75 per share. The dividend expected to be paid at the end of the coming year is $5. Its dividend payments have been growing at a constant rate for the last five years. Five years ago, the dividend was $3.10. It is expected that to sell, a new common stock issue must be underpriced $2 per share and the firm must pay $1 per share in flotation costs. Additionally, the firm has a marginal tax rate of 40 percent.

-Assuming the firm plans to pay out all of its earnings as dividends, the weighted average cost of capital is ________. (See Table 9.2)

Definitions:

Self-Sufficient Subsidiary

A subsidiary that operates independently from its parent company, having its own financial systems, resources, and capabilities to sustain its operations.

Total Assets

The sum of all assets owned by an entity, representing the total resources at its disposal for operations or investments.

Current-Rate Method

An accounting method used to convert the financial statements of a foreign subsidiary into the parent company’s reporting currency by applying the current exchange rate.

Temporal Method

An exchange rate conversion technique where monetary assets and liabilities are converted at historical rates, while non-monetary assets and liabilities are converted at the current rate.

Q2: How many grams of U-235 must be

Q3: In an experiment different wavelengths of light,all

Q8: What,approximately,are the dimensions of the smallest object

Q13: The strong nuclear interaction has a range

Q25: Tangshan China's stock is currently selling for

Q39: Linus claims that the added gravitational force

Q44: When you look at a single slit

Q51: The beta of the portfolio in Table

Q105: A call feature in a bond allows

Q191: Bondholders will convert their convertible bonds into