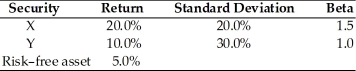

Table 8.3

Consider the following two securities X and Y.

-Using the data from Table 8.3, what is the portfolio expected return and the portfolio beta if you invest 35 percent in X, 45 percent in Y, and 20 percent in the risk-free asset?

Definitions:

Farm Commodities

Basic agricultural products that are used both for consumption and as inputs in the production of other goods.

Food Products

Food products encompass items that are processed, prepared, and packaged to be consumed as meals or snacks.

Price Elasticity Coefficient

A measure of how much the quantity demanded of a good responds to a change in the price of that good, indicating sensitivity to price changes.

Farm Products

Goods that are produced by farming activities, such as crops, livestock, and other agricultural commodities.

Q29: The _ rate of interest creates equilibrium

Q30: In the Lawson number what do the

Q33: When calculating the rotational kinetic energy of

Q46: Two nuclei which share the same atomic

Q46: In the capital asset pricing model, the

Q58: In a bond indenture, the term security

Q67: If you were to create a portfolio

Q152: The three theories cited to explain the

Q155: Combining two assets having perfectly negatively correlated

Q187: Investment A guarantees its holder $100 return.