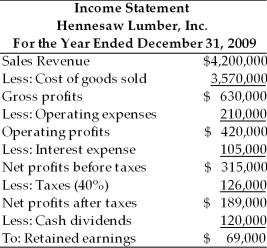

Table 4.4

Use the percent-of-sales method to prepare a pro forma income statement for the year ended December 31, 2010, for Hennesaw Lumber, Inc.

Hennesaw Lumber, Inc. estimates that its sales in 2000 will be $4,500,000. Interest expense is to remain unchanged at $105,000 and the firm plans to pay cash dividends of $150,000 during 2010. Hennesaw Lumber, Inc.'s income statement for the year ended December 31, 2009 is shown below. From your preparation of the pro forma income statement, answer the following multiple choice questions.

-The pro forma accumulated retained earnings account on the balance sheet is projected to ________. (See Table 4.4)

Definitions:

Operating Expenses

Costs related to the day-to-day functioning of a business, excluding the cost of production.

Product Costs

The costs directly associated with the production of goods, including raw materials, labor, and manufacturing overhead.

Indirect Costs

Expenses not directly tied to a specific product, service, project, or activity, typically including utilities, rent, and administrative salaries.

Cost Object

Any item for which costs are measured and assigned, including products, services, projects, activities, or customers.

Q14: An efficient market is a market that

Q65: The tax liability of a corporation with

Q79: Construct the DuPont system of analysis using

Q83: In a _ market, the buyer and

Q114: Calculate the present value of $89,000 to

Q132: Adam borrows $4,500 at 12 percent annually

Q160: Firm ABC had operating profits of $100,000,

Q162: Assume you have a choice between two

Q168: The return on total assets for Dana

Q169: Floating-rate bonds are bonds that can be