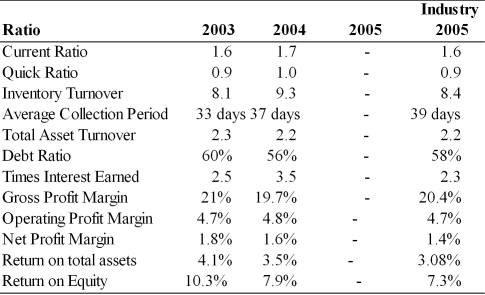

Given the following balance sheet, income statement, historical ratios and industry averages, calculate the Pulp, Paper, and Paperboard, Inc. financial ratios for the most recent year. Analyze its overall financial situation for the most recent year. Analyze its overall financial situation from both a cross-sectional and time-series viewpoint. Break your analysis into an evaluation of the firm's liquidity, activity, debt, and profitability.

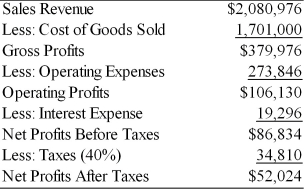

Income Statement

Pulp, Paper and Paperboard, Inc.

For the Year Ended December 31, 2005  Balance Sheet

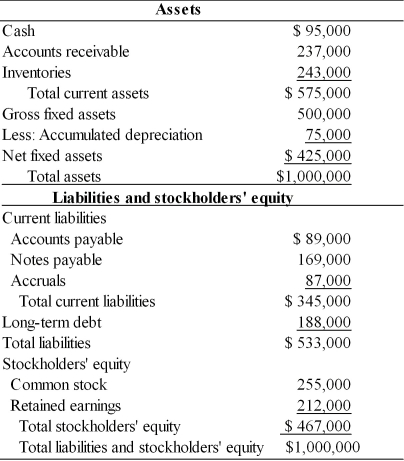

Balance Sheet

Pulp, Paper and Paperboard, Inc.

December 31, 2005  Historical and Industry Average Ratios

Historical and Industry Average Ratios

Pulp, Paper and Paperboard, Inc.

Definitions:

Actor-Observer Effect

A cognitive bias in which people tend to attribute their own actions to situational factors, while attributing others' actions to their character or disposition.

Traffic

The movement of vehicles, ships, persons, or animals through an area, or the volume of this movement in a specified pathway or domain, such as internet traffic.

Cognitively Draining Task

Tasks that require a high level of mental effort and concentration, often leading to mental exhaustion.

Anxiety-Provoking Topics

Subjects or issues that tend to elicit feelings of anxiety or discomfort when discussed or thought about.

Q9: Net operating profit after taxes (NOPAT) represents

Q14: A firm with a cash conversion cycle

Q17: Appropriate collateral for a secured short-term loan

Q18: For any interest rate and for any

Q38: Discuss the limitations of ratio analysis and

Q69: Tina's Apple Company would like to manufacture

Q70: Present and prospective shareholders are mainly concerned

Q83: Typically, higher coverage ratios are preferred, but

Q115: What is the rate of return on

Q185: A firm has an operating cycle of