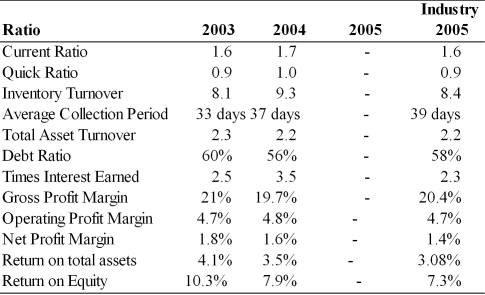

Given the following balance sheet, income statement, historical ratios and industry averages, calculate the Pulp, Paper, and Paperboard, Inc. financial ratios for the most recent year. Analyze its overall financial situation for the most recent year. Analyze its overall financial situation from both a cross-sectional and time-series viewpoint. Break your analysis into an evaluation of the firm's liquidity, activity, debt, and profitability.

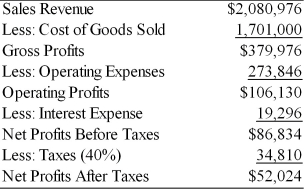

Income Statement

Pulp, Paper and Paperboard, Inc.

For the Year Ended December 31, 2005  Balance Sheet

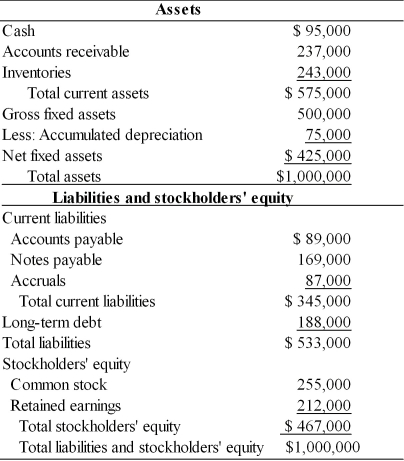

Balance Sheet

Pulp, Paper and Paperboard, Inc.

December 31, 2005  Historical and Industry Average Ratios

Historical and Industry Average Ratios

Pulp, Paper and Paperboard, Inc.

Definitions:

Great Pyramid

The largest of the three pyramids at Giza, Egypt, built as a tomb for Pharaoh Khufu (Cheops) around 2580-2560 B.C.

Water Reservoirs

Artificial or natural lakes used for the storage and regulation of water for purposes such as human consumption, irrigation, and industrial use.

Worldview

A comprehensive perspective through which individuals or groups interpret and interact with the world around them, encompassing beliefs, values, and customs.

Internal Factors

Elements within an organization or system that influence its operations, such as employee skills, corporate culture, and management policies.

Q10: The statement of cash flows may also

Q20: The average age of inventory can be

Q25: The net fixed asset investment (NFAI) is

Q77: Most commercial paper is purchased by<br>A) manufacturers.<br>B)

Q78: The prime rate of interest fluctuates with

Q80: Factoring accounts receivable is a relatively expensive

Q103: Required financing and excess cash are typically

Q126: Commercial finance companies are lending institutions that

Q130: _ analysis involves comparison of current to

Q139: The aggressive financing strategy is risky due