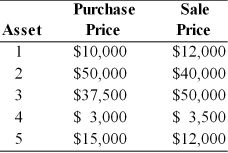

During 2002, a firm has sold 5 assets described below. Calculate the tax liability on the assets. The firm pays a 40 percent tax rate on ordinary income.

Definitions:

Required Reserves

The minimum amount of funds that a bank must hold in reserve against deposits, as mandated by monetary authorities.

Excess Reserves

The reserves that banks hold over and above the legally mandated minimum to meet withdrawal demands.

Federal Reserve Open Market Committee

The branch of the Federal Reserve System responsible for influencing money supply and credit conditions through the trading of government securities.

Board of Governors

The executive leadership of the Federal Reserve System, responsible for the formulation of monetary policies in the United States.

Q5: _ involves the sale of accounts receivable.<br>A)

Q26: In the OTC market, the prices at

Q36: Mortgage-backed securities are securities that represent claims

Q40: A bank lends a firm $1,000,000 for

Q82: The risk to a U.S. importer with

Q108: A firm with a total asset turnover

Q117: The _ measures the overall effectiveness of

Q124: Fixed assets are the most desirable short-term

Q126: Commercial finance companies are lending institutions that

Q324: Certain financing plans are termed conservative when<br>A)