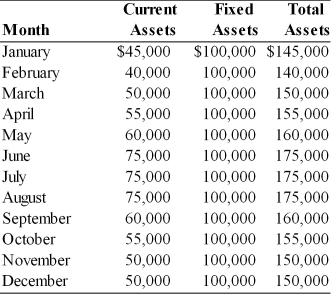

Table 14.1

Irish Air Services has determined several factors relative to its asset and financing mix.

(a) The firm earns 10 percent annually on its current assets.

(b) The firm earns 20 percent annually on its fixed assets.

(c) The firm pays 13 percent annually on current liabilities.

(d) The firm pays 17 percent annually on long-term funds.

(e) The firm's monthly current, fixed and total asset requirements for the previous year are summarized in the table below:

-The firm's monthly average permanent funds requirement is ________. (See Table 14.1)

Definitions:

Units Sold

The total quantity of a product that has been sold during a specific period.

Direct Costs

Expenses that can be directly tied to the production of a specific good or service, such as raw materials and labor.

Shoe Department

A specialized division within a retail store or company dedicated to the sale and promotion of footwear.

Fixed Manufacturing Cost

Costs that do not vary with the level of production output, such as rent, salaries, and insurance, which are necessary for the production process but remain constant regardless of the units produced.

Q27: The more predictable a firm's cash inflows,

Q85: A primary market is a financial market

Q91: _ is a method of consciously anticipating

Q106: A firm that is unable to pay

Q125: The firm's operating breakeven point is the

Q158: A negative cash conversion cycle (CCC) means

Q168: The return on total assets for Dana

Q260: Ideally a firm would like to have

Q277: If the firm relaxes its credit standards,

Q314: A decrease in collection efforts will result