Table 11.3

Fine Press is considering replacing the existing press with a more efficient press. The new press costs $55,000 and requires $5,000 in installation costs. The old press was purchased 2 years ago for an installed cost of $35,000 and can be sold for $20,000 net of any removal costs today. Both presses are depreciated under the MACRS 5-year recovery schedule. The firm is in 40 percent marginal tax rate.

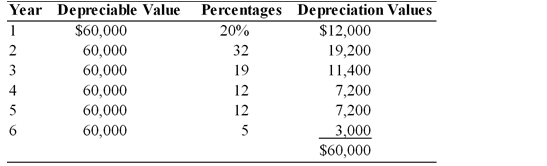

-Calculate the book value of the existing press being replaced. (See Table 11.3)

Definitions:

Price Elasticity of Demand

A gauge for understanding how sensitive the demand for a product is to price changes.

Comprehensive Environmental Response

An extensive approach or policy aimed at addressing and remedying environmental pollution and hazards, often referring to legislation like the Comprehensive Environmental Response, Compensation, and Liability Act (CERCLA).

Hazardous Waste

Waste materials that are dangerous or potentially harmful to human health or the environment.

Disposal Sites

Locations designated for the disposal or treatment of waste materials.

Q60: One way often used to insure that

Q61: Simulation is an approach that evaluates the

Q63: What is the degree of financial leverage

Q73: Using the internal rate of return approach

Q82: The accept-reject approach involves the ranking of

Q96: The risk-adjusted discount rate approach to evaluating

Q126: The officer responsible for the firm's accounting

Q139: Projects that compete with one another, so

Q154: All of the following must be considered

Q323: Controlled disbursing is a method of consciously