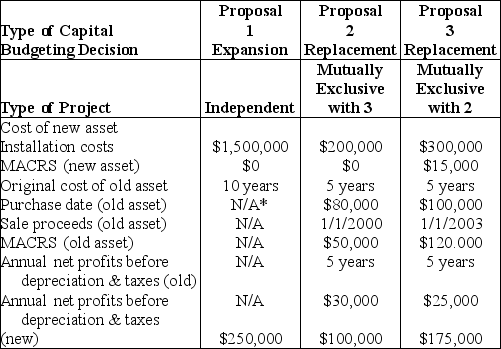

Table 11.4

Computer Disk Duplicators, Inc. has been considering several capital investment proposals for the year beginning in 2004. For each investment proposal, the relevant cash flows and other relevant financial data are summarized in the table below. In the case of a replacement decision, the total installed cost of the equipment will be partially offset by the sale of existing equipment. The firm is subject to a 40 percent tax rate on ordinary income and on long-term capital gains. The firm's cost of capital is 15 percent.

*Not applicable

*Not applicable

-For Proposal 1, the cash flow pattern for the expansion project is ________. (See Table 11.4)

Definitions:

Bronchitis

An inflammation of the bronchial tubes in the lungs, usually caused by infection or exposure to irritants.

Preterm Labor

The condition of a pregnant woman going into labor before 37 weeks of gestation, potentially leading to premature birth.

Respiratory Distress Syndrome

A serious condition where the lungs cannot provide sufficient oxygen to the body's blood, often seen in premature infants.

Fetal Development

The process of growth and maturation of a fetus inside the mother's womb.

Q5: What is the IRR for the following

Q15: The payment date is five days after

Q47: The accrual method recognizes revenue at the

Q67: When the net present value is negative,

Q89: Making financing decisions includes all of the

Q97: _ arise from a short-term credit arrangement

Q113: Financial services are concerned with the duties

Q147: The payback period is the amount of

Q191: The net present value of the project

Q310: Federal agency issues are obligations of the