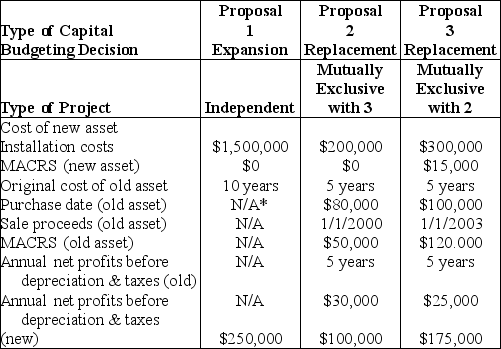

Table 11.4

Computer Disk Duplicators, Inc. has been considering several capital investment proposals for the year beginning in 2004. For each investment proposal, the relevant cash flows and other relevant financial data are summarized in the table below. In the case of a replacement decision, the total installed cost of the equipment will be partially offset by the sale of existing equipment. The firm is subject to a 40 percent tax rate on ordinary income and on long-term capital gains. The firm's cost of capital is 15 percent.

*Not applicable

*Not applicable

-For Proposal 2, the tax effect on the sale of the existing asset results in ________. (See Table 11.4)

Definitions:

Treasury Bond

Long-term government debt securities with a fixed interest rate and maturity of more than 10 years.

Short-Term

A period of time that is relatively brief, usually focusing on immediate or near-future events or goals, often contrasted with long-term perspectives.

Student Loans

Borrowed money that is used to pay for educational expenses and is expected to be paid back with interest.

Discount Rate

The rate of interest applied to loans provided to commercial banks and other financial institutions by the Federal Reserve through its discount window.

Q6: Mutually exclusive projects are projects whose cash

Q26: Which of the following capital budgeting techniques

Q36: If an investment in a new asset

Q67: The accounting in a stock split will

Q119: Marginal cost-benefit analysis states that financial decisions

Q121: The minimum return that must be earned

Q161: Operating leverage measures the effect of fixed

Q180: A corporation is selling an existing asset

Q216: All of the following securities are government

Q302: Eurodollar deposits are deposits of currency that