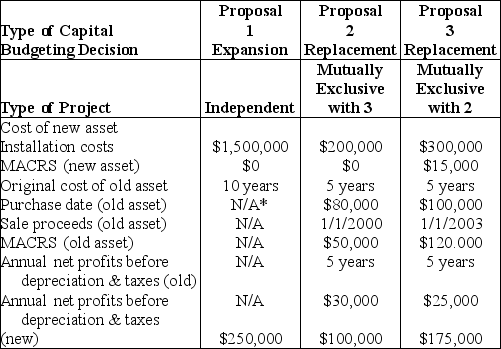

Table 11.4

Computer Disk Duplicators, Inc. has been considering several capital investment proposals for the year beginning in 2004. For each investment proposal, the relevant cash flows and other relevant financial data are summarized in the table below. In the case of a replacement decision, the total installed cost of the equipment will be partially offset by the sale of existing equipment. The firm is subject to a 40 percent tax rate on ordinary income and on long-term capital gains. The firm's cost of capital is 15 percent.

*Not applicable

*Not applicable

-For Proposal 3, the cash flow pattern for the replacement project is ________. (See Table 11.4)

Definitions:

Leadership Situation

The context or environment in which leadership occurs, including the tasks, challenges, relationships, and cultural factors that influence leadership processes and effectiveness.

Leader's Choice

Refers to the decisions made by a leader that can influence the direction, strategy, or performance of an organization or group.

Influences Behavior

The process by which individuals change or modify their actions based on internal or external factors.

Quantitative Data

Numerically based information that can be measured and analyzed statistically.

Q4: Generally, legal constraints prohibit the payment of

Q58: The current market price of a company's

Q114: Generally, _ in leverage result in _

Q114: A sunk cost is a cash flow

Q123: Because of the extensive research conducted in

Q130: The wealth of corporate owners is measured

Q153: _ refers to funds that have been

Q160: Tangshan Mining Company, with a cost of

Q187: Controlled disbursing involves the strategic use of

Q234: The yields on Treasury bills are generally