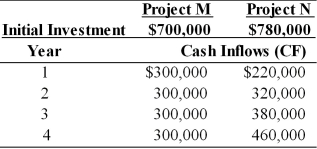

Table 11.9

Tangshan Mining Company is considering investment in one of two mutually exclusive projects M and N which are described below. Tangshan Mining's overall cost of capital is 15 percent, the market return is 15 percent and the risk-free rate is 5 percent. Tangshan estimates that the beta for project M is 1.20 and the beta for project N is 1.40.

-Using the risk-adjusted discount rate method of project evaluation, the better investment for Tangshan Mining is (See Table 11.9)

Definitions:

Pioneering Contributors

Individuals who have made significant foundational contributions in their field of expertise.

Third World Countries

A term originally used to describe countries not aligned with NATO or the Communist Bloc, now often used to refer to developing or low-income countries.

Eastern Hemisphere

The half of Earth that lies east of the Prime Meridian and west of the 180th meridian, encompassing continents like Asia, Africa, Europe, and Australia.

Universal Process Approach

The Universal Process Approach is a framework suggesting that there are common processes and practices that can be applied across various management and organizational contexts to achieve success.

Q7: Because of uncertainty of demand, a firm

Q15: If accounts payable are paid 10 times

Q39: When trying to assess the credit standing

Q48: What is the assessment method widely used

Q55: The advantage of using the low-regular-and-extra dividend

Q59: Managerial finance<br>A) involves tasks such as budgeting,

Q71: The "treasury stock" is an accounting entry

Q99: Which of the following statements is most

Q110: The part of finance concerned with design

Q155: Which plan has a higher degree of