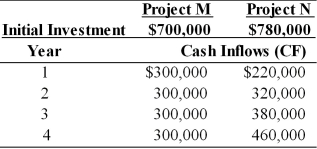

Table 11.9

Tangshan Mining Company is considering investment in one of two mutually exclusive projects M and N which are described below. Tangshan Mining's overall cost of capital is 15 percent, the market return is 15 percent and the risk-free rate is 5 percent. Tangshan estimates that the beta for project M is 1.20 and the beta for project N is 1.40.

-Which project, M or N, would be preferable if both projects were of average risk as the overall firm and Tangshan Mining has a beta of 1.0? (See Table 11.9)

Definitions:

Search Terms

Words or phrases entered into a search engine or database query to find specific information.

Wolfram Alpha

A computational knowledge engine that provides answers to factual queries directly by computing the answer from externally sourced data.

Factual Questions

Questions that can be answered with specific pieces of information, often verifiable and based on facts.

Public Domain

Works that are not protected by copyright law and are freely available for use by the public without restrictions.

Q7: Because of uncertainty of demand, a firm

Q7: The base level of EBIT must be

Q8: Dividend reinvestment plans (DRIPs) enable stockholders to

Q14: The potential benefits forgone by rejecting one

Q45: Which of these is not a cost

Q47: The repurchase of stock _ the earnings

Q54: Compute the initial purchase price for an

Q62: A sophisticated capital budgeting technique that can

Q77: The payment of a stock dividend is

Q130: Capital budgeting techniques are used to evaluate