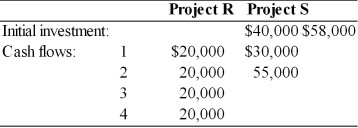

A firm is evaluating two mutually exclusive projects that have unequal lives. The firm must evaluate the projects using the annualized net present value approach and recommend which project they should select. The firm's cost of capital has been determined to be 14 percent, and the projects have the following initial investments and cash flows:

Definitions:

Tube Feedings

A medical procedure to provide nutrition to individuals who cannot obtain nutrition by mouth, utilizing a tube placed in the stomach or intestine.

Schizophrenia

A complex, long-term mental health disorder characterized by distorted thinking, perceptions, emotions, language, sense of self, and behavior.

Acute Dystonic Reaction

A sudden, severe involuntary muscle contraction, often a side effect of certain psychiatric medications.

Diphenhydramine

An antihistamine drug used to relieve symptoms of allergy, hay fever, and the common cold, as well as for inducing sleep.

Q15: The capital expenditures analyst/manager is responsible for

Q28: If the firm's earnings remain constant and

Q34: Which of the following statements about securitisation

Q40: In the dividend relevance arguments, current dividend

Q75: Holding all other factors constant, a firm

Q85: The three basic types of leverage are<br>A)

Q114: Economic value added is the difference between

Q133: In theory, the firm should maintain financial

Q151: Firms having stable and predictable revenues can

Q198: Holding all other factors constant, a firm