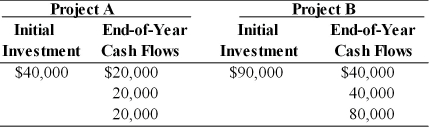

Table 10.4

A firm is evaluating two projects that are mutually exclusive with initial investments and cash flows as follows:

-If the firm in Table 10.4 has a required payback of two (2) years, it should

Definitions:

Federal Bankruptcy Exemptions

Provisions allowing an individual to exempt certain types of property from the bankruptcy estate, thus protecting them from being seized to pay off creditors under federal bankruptcy law.

Liquidation

The process of closing a business and distributing its assets to claimants, typically occurring when a company is insolvent.

Perfection

In legal and financial contexts, perfection refers to the process of securing a legal claim or interest, ensuring its enforceability against third parties, especially in cases of bankruptcy or sale of the associated collateral.

Luxury Goods

High-end products that are often considered status symbols, characterized by their quality, price, and prestige beyond the basic functional necessity.

Q25: Which of the following could result from

Q44: The IRR method assumes the cash flows

Q45: Calculate the incremental depreciation. (See Table 11.6)

Q51: An example of a variable cost is:<br>A)Manager's

Q55: Since the payback period can be viewed

Q58: The approach to overhead costs under activity-based

Q89: Calculate the NPV of projects X and

Q95: Because a business firm can be viewed

Q114: A sunk cost is a cash flow

Q171: Financial leverage measures the effect of fixed