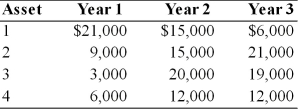

A financial manager must choose between four alternative Assets: 1, 2, 3, and 4. Each asset costs $35,000 and is expected to provide earnings over a three-year period as described below.  Based on the profit maximization goal, the financial manager would choose

Based on the profit maximization goal, the financial manager would choose

Definitions:

Non-Operating Items

Income or expenses that are not related to a company's core business operations, often including gains or losses from investment or interest expenses.

Loss From Operations

A financial situation where a company's operating expenses exceed its gross profits, indicating inefficiency in business operations.

Operating Expenses

Expenses incurred through normal business operations, such as rent, wages, and utilities, excluding the cost of goods sold.

Gross Profit

The difference between the revenue generated from sales and the cost of goods sold, before deducting operating expenses, interests, and taxes.

Q4: What does full cost represent?<br>A)only semi-variable costs.<br>B)variable

Q17: The tax treatment regarding the sale of

Q33: The Talent Agency had the following

Q38: For short-run decisions, which costs can normally

Q43: Using the net present value approach to

Q75: If a new asset is being considered

Q79: The steeper the slope of the EBIT-EPS

Q126: In comparing the internal rate of return

Q128: In spite of the theoretical superiority of

Q136: The breakeven cash inflow is the minimum