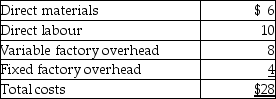

Speck Company manufactures a part for its production cycle. The costs per unit for 10,000 units of this part are as follows:

The fixed factory overhead costs are unavoidable.

The fixed factory overhead costs are unavoidable.

-Assume that Speck can buy 10,000 units of the part from another producer for $28 each. The current facilities could be used to make 10,000 units of a product that has a contribution margin of $10 per unit. No additional fixed costs would be incurred. Speck should

Definitions:

Payroll Taxes Deposits

Payments made by employers to the IRS or other tax authorities for taxes withheld from employees' wages, including Social Security and Medicare taxes.

Lookback Period

The lookback period is a defined timeframe in the past during which certain events or transactions are reviewed for tax or regulatory compliance purposes.

TIN

Taxpayer Identification Number; a unique identifier assigned by the Internal Revenue Service or Social Security Administration to track taxpayers and accounts.

W-9 Forms

A request for taxpayer identification number and certification, used in the United States to provide information to entities that pay you income.

Q26: The costs of manufacturing joint products after

Q32: Physical hazards associated with home O<sub>2 </sub>therapy

Q38: Which of the following cardiovascular signs would

Q50: Morrow, Inc. has three departments. Data for

Q54: During exercise, the point at which increased

Q55: What is the most important prerequisite for

Q80: Assuming the physical-units method of allocating joint

Q82: Russell Company had the following balances as

Q91: The average number of times the inventory

Q112: Which of the following are acceptable methods