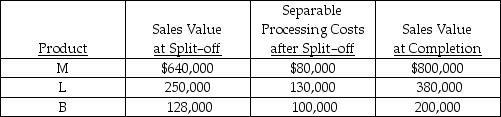

Avey Corporation has a joint process which produces three products, M, L and B. Each product may be sold at split-off or processed further and then sold. Joint processing costs for a year amount to $500,000. Other relevant data are as follows:

-Once product M is produced, processing it further will cause profits to

Definitions:

Tax Returns

The documents filed with a taxing authority that report income, expenses, and other pertinent tax information.

Penalties

Sanctions or punishments imposed for breaking a law, rule, or contract.

Taxpayer

An individual or entity obligated to pay taxes to governmental authorities based on earnings or property ownership.

Securities Violations

Illegal activities involving the trading or handling of securities, such as insider trading, fraud, or manipulation of the market.

Q1: What type of information is associated with

Q3: What is the level of involvement of

Q8: If total payroll processing costs are $40,000

Q9: You measure the spontaneous rate of

Q14: Which of the following techniques is NOT

Q67: Which of the following functions should a

Q67: Service department costs should be allocated directly

Q71: Which of the data provided in the

Q73: What agency is primarily responsible for voluntary

Q84: Marginal cost is the additional cost resulting