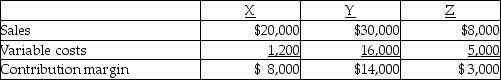

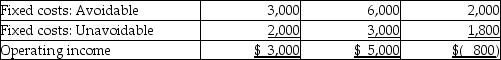

Ulmer Company has three product lines, X, Y, and Z. The following information is available:

-Assuming product line Z is discontinued and the space formerly used to produce product Z is rented for $4,000 per year, operating income will

Definitions:

LIFO Reserve

The difference between the cost of inventory calculated under the Last-In, First-Out method and the FIFO method.

LIFO

Last-In, First-Out, an inventory management method where the most recently produced or acquired items are sold first.

FIFO

An inventory valuation method that assumes the first items placed in inventory are the first sold, standing for 'First In, First Out'.

GAAP

Generally Accepted Accounting Principles, a set of accounting standards and procedures used in the United States to govern financial reporting.

Q2: Assume that Pett can buy 5,000 units

Q22: Which of the following is NOT an

Q27: Which of the following methods is useful

Q66: Make-or-buy decisions can apply to services as

Q68: Which of the following are good candidates

Q80: A report that summarizes the manufacturing activity

Q91: The average number of times the inventory

Q107: Which patients are better suited for subacute

Q110: Henry Company has three support departments and

Q113: Which of the following would you recommend