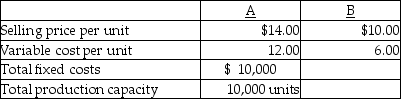

Drummer produces two products, A and B. The following information is available for these two products:

-If only 5,000 units of each product, A and B can be sold, it would be best to

Definitions:

Sales Taxes

Taxes imposed by governmental entities on sales of goods and services, typically collected at the point of sale from the consumer.

Regressive

Referring to a tax system where the tax rate decreases as the taxable amount increases, placing a higher relative burden on lower-income earners.

Progressive

Pertaining to political, social, or economic beliefs favoring or promoting changes, reforms, or innovations.

Personal Taxes

Taxes levied on individuals based on their income, wealth, or property ownership, affecting disposable income and purchasing power.

Q22: Radlin Inc. has just completed its first

Q23: Which of the following is considered a

Q26: Relative contraindications for using noninvasive positive-pressure ventilation

Q34: The predicted future costs and revenues that

Q39: A relevant costing analysis that focuses on

Q45: A home care patient using a reservoir

Q60: One cubic foot (1 cu/ft) of liquid

Q82: Russell Company had the following balances as

Q92: The ending inventory under variable costing would

Q105: Any activity for which a separate measurement