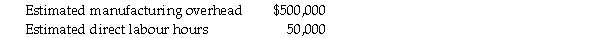

The FSR Company uses a budgeted factory overhead rate to apply manufacturing overhead to production. The rate is based on direct labour hours. Estimates for the year 2006 are given below:  During 2006 the Paine Company used 60,000 direct labour hours. At the end of 2006, the company's records revealed the following information:

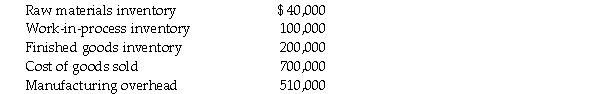

During 2006 the Paine Company used 60,000 direct labour hours. At the end of 2006, the company's records revealed the following information:  a. Calculate the budgeted overhead rate for 2006.

a. Calculate the budgeted overhead rate for 2006.

b. Determine the amount of underapplied or overapplied overhead for 2006.

c. If underapplied or overapplied overhead is treated as an adjustment to cost of goods sold, determine the cost of goods sold that would appear on the company's income statement.

Definitions:

Fixed

Refers to something that is unchanging and stable, often used in the context of expenses or assets that do not vary with production volume.

Variable

An element, feature, or factor that is likely to vary or change; in scientific experiments, this is the factor being tested or measured.

Product Cost

Product cost refers to the total expenditure incurred to create a product, including direct materials, direct labor, and manufacturing overhead.

Period Cost

Expenses on a company's income statement that are not directly tied to the production of goods or services and are expensed in the period they are incurred.

Q1: The total cost of ending work-in-process inventory

Q24: What is the purpose of the small

Q50: Morrow, Inc. has three departments. Data for

Q54: One conventional way of allocating joint costs

Q59: If the tax rate is 40 percent,

Q64: Which of the following factors would you

Q67: Service department costs should be allocated directly

Q92: The ending inventory under variable costing would

Q117: What is the major potential problem in

Q121: Which of the following methods is required