IIF Industries uses a job-order costing system and applies overhead on the basis of direct labour hours.

At the beginning of 2006, management estimated that 200,000 direct labour hours would be worked and $600,000 of overhead costs would be incurred.

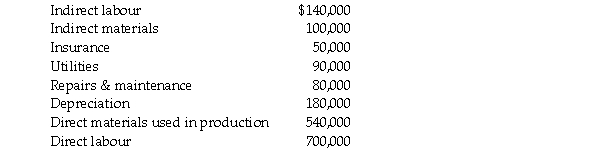

During the year, the company actually worked 220,000 direct labour hours and incurred the following manufacturing costs:  a. Calculate the budgeted factory overhead application rate for 2006.

a. Calculate the budgeted factory overhead application rate for 2006.

b. Determine the amount of manufacturing overhead applied to work in process during 2006.

c. Determine the amount of underapplied or overapplied overhead for the year.

d. If goods with a cost of $1,500,000 were completed and transferred to finished goods during 2006, determine the cost of work in process at the end of the period.

e. Prepare the journal entry to close underapplied or overapplied overhead to cost of goods sold.

Definitions:

Variable Cost Estimates

Projections of costs that change in relation to the level of production or sales volume.

Facility Expenses

Costs associated with the physical maintenance and operation of a business's buildings and equipment.

Tenant-Days

A measure used in the real estate and hospitality sectors, representing the total number of days that tenants occupy a property.

Budgeting Formulas

Mathematical expressions or guidelines used in the process of preparing budgets to estimate revenues, expenses, and net income.

Q1: Which of the following would NOT be

Q11: Berlau Corp. manufactures two models of its

Q27: How much of the account inquiry cost

Q34: An accounting system that applies costs to

Q36: If total fixed costs increased to $156,750,

Q50: How many inventory accounts does a merchandiser

Q60: If the step-down method is used to

Q65: The budgeted factory overhead rate for applying

Q79: Using absorption costing, cost of goods sold

Q123: If the direct method is used to