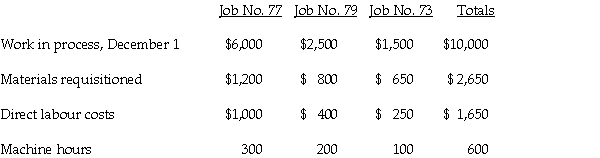

Cowbell Incorporated uses a job-order costing system and a budgeted factory overhead rate based on machine hours. At the beginning of the year, Cowbell estimated manufacturing overhead for the year at $50,000. Machine hours were estimated at 8,000. The following information pertains to December of the current year:  Actual manufacturing overhead costs incurred in December were $5,000 of which $1,000 was depreciation on the factory building and $500 was depreciation on the production equipment.

Actual manufacturing overhead costs incurred in December were $5,000 of which $1,000 was depreciation on the factory building and $500 was depreciation on the production equipment.

a. Compute the budgeted factory overhead application rate.

b. Prepare the journal entries to record the activity for the month of December.

c. Determine the cost associated with each job.

d. If Job No. 77 was completed during December, what is the balance of Work in Process as at December 31?

e. If there was no balance in the Overhead Control account on December 1, what is the balance as at December 31?

f. Prepare the journal entry to close underapplied or overapplied overhead to cost of goods sold.

Definitions:

Indirect Materials

Materials used in the production process but not directly traceable to a finished product, such as lubricants and adhesives for machinery.

Payroll Payable

A liability account that records the amounts owed to employees for wages or salaries that have been earned but not yet paid.

Work-in-Process Inventory

Work-in-process inventory includes all the materials, labor, and overhead costs for products that are in the production process but are not yet complete.

Labor Distribution Report

A report issued by the payroll department to categorize all the types of labor incurred during the week.

Q12: A product-costing method that assigns all manufacturing

Q23: _ selects a volume-related cost driver and

Q25: If Beem Corporation could produce and sell

Q32: The cost of goods sold under absorption

Q49: The Orton Company produces two types of

Q52: To avoid product failure, transtracheal catheters and

Q59: A cost accumulation method that accumulates costs

Q90: Given a break-even point of 44,000 units

Q95: The juncture in manufacturing where the joint

Q120: What are some disadvantages of O<sub>2 </sub>concentrators